ERP software for payroll has revolutionized the way organizations manage payroll processes, offering a comprehensive solution that streamlines operations, reduces costs, and ensures compliance. This article delves into the key benefits, features, and best practices of ERP payroll systems, providing insights into how they can transform payroll management.

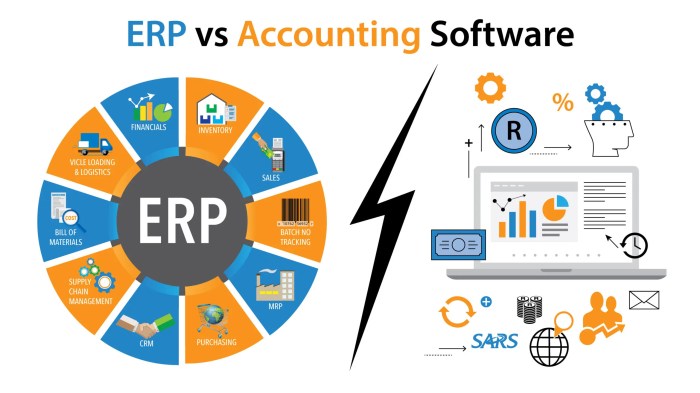

ERP Software Overview

ERP, short for Enterprise Resource Planning, is a software suite that assists businesses in managing their essential operations. These systems integrate various business processes into a unified platform, enabling seamless data flow and centralized control over critical functions.ERP systems offer numerous advantages, including improved operational efficiency, enhanced decision-making, and reduced costs.

They provide real-time visibility into key business metrics, allowing companies to identify areas for improvement and make informed decisions based on accurate data. Additionally, ERP systems streamline processes, eliminating manual tasks and automating workflows, leading to significant time and cost savings.

Key Features of ERP Systems

ERP systems encompass a comprehensive range of features that support various business functions. These include:

- Financial management: Automates accounting, budgeting, and financial reporting.

- Human capital management: Streamlines HR processes, including payroll, benefits administration, and talent management.

- Supply chain management: Optimizes inventory management, purchasing, and logistics.

- Customer relationship management (CRM): Provides a centralized platform for managing customer interactions, sales, and marketing.

- Business intelligence and analytics: Enables businesses to analyze data and generate insights to support decision-making.

Payroll Management in ERP

ERP software revolutionizes payroll processes by automating and streamlining various tasks, leading to increased efficiency and reduced manual errors. The integration of payroll functions within an ERP system allows for seamless data flow and real-time updates, ensuring accuracy and compliance.

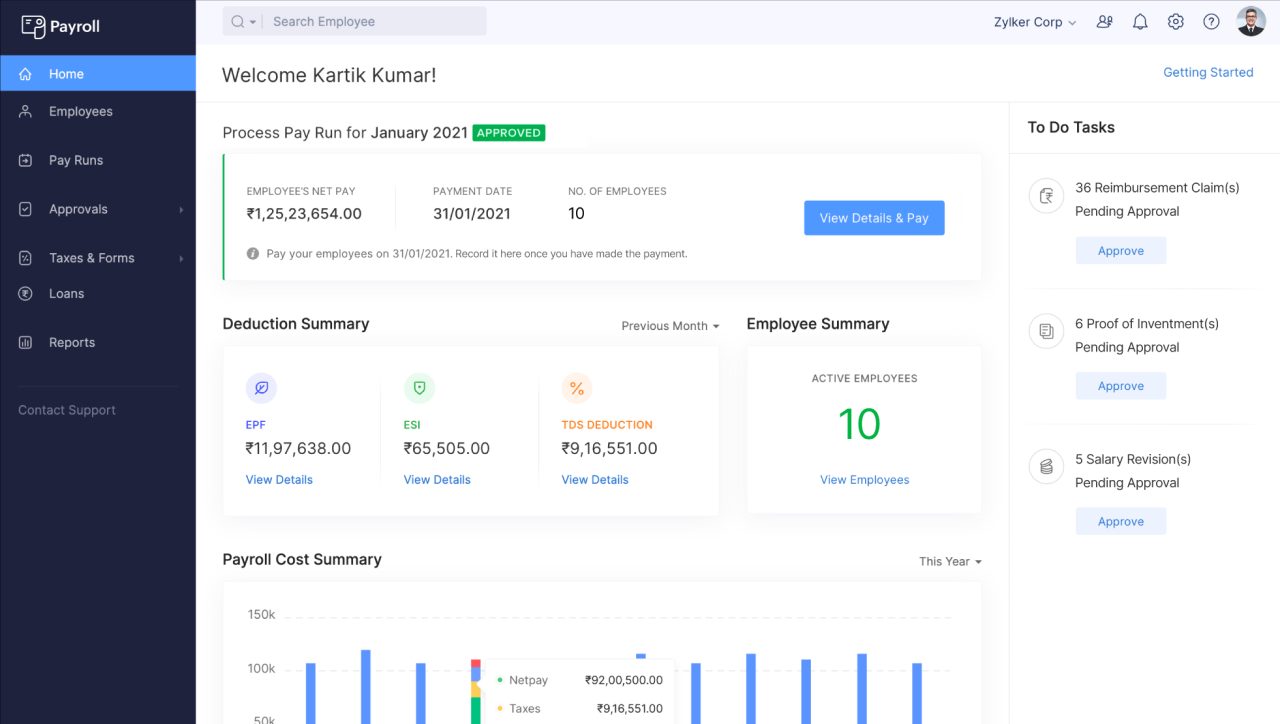

Core Payroll Functions in ERP Systems

ERP systems typically encompass a comprehensive suite of payroll functions, including:

- Employee Information Management:Centralized storage and management of employee data, including personal details, job information, and payroll-related data.

- Time and Attendance Tracking:Integration with timekeeping systems to track employee hours, overtime, and absences, ensuring accurate payroll calculations.

- Payroll Calculations:Automatic calculation of salaries, wages, deductions, and taxes based on predefined rules and employee data.

- Paycheck Distribution:Flexible options for distributing paychecks, including direct deposit, paper checks, or payroll cards.

- Tax and Compliance Management:Automated calculation and filing of payroll taxes, including federal, state, and local taxes, ensuring compliance with regulatory requirements.

- Reporting and Analytics:Generation of comprehensive payroll reports, including payroll summaries, tax reports, and other customized reports for analysis and decision-making.

Benefits of ERP for Payroll

Implementing ERP software for payroll management offers numerous advantages, including significant cost savings, efficiency improvements, and enhanced compliance.

Cost Savings

ERP systems automate payroll processes, eliminating the need for manual calculations and data entry. This reduces labor costs and minimizes errors, leading to substantial cost savings.

Efficiency Improvements

ERP software streamlines payroll processes, allowing HR professionals to manage payroll more efficiently. Automated workflows and real-time data updates ensure that payroll is processed accurately and on time, freeing up time for other strategic tasks.

Compliance Benefits

ERP systems ensure compliance with complex payroll regulations and tax laws. They automatically calculate deductions, withholdings, and other compliance-related factors, reducing the risk of penalties and legal liabilities.

Selection Criteria for ERP Payroll

When selecting an ERP payroll system, organizations should establish key criteria to evaluate and compare different solutions. These criteria should align with the specific needs and requirements of the organization, ensuring the selected system meets its unique objectives and challenges.

Key factors to consider include:

Scalability

- Assess the system’s ability to handle current and future payroll volumes, including the number of employees, payrolls, and transactions.

- Consider the system’s capacity to accommodate growth and expansion, ensuring it can scale seamlessly as the organization’s needs evolve.

Vendor Support

- Evaluate the vendor’s reputation, experience, and financial stability.

- Consider the level of support provided, including technical assistance, software updates, and regulatory compliance guidance.

- Assess the vendor’s responsiveness and availability, ensuring they can provide timely and effective support when needed.

Industry-Specific Requirements

- Identify any industry-specific regulations or compliance requirements that must be met by the payroll system.

- Consider the system’s ability to handle unique industry-specific calculations, such as union dues, overtime pay, or commission structures.

- Ensure the system aligns with industry best practices and standards, enhancing efficiency and reducing the risk of errors.

Implementation and Integration

Implementing an ERP payroll system involves a series of steps to ensure successful integration into an organization’s existing infrastructure. The key steps include:

- System Analysis:Analyze current payroll processes and identify areas for improvement and automation.

- Software Selection:Evaluate different ERP payroll software solutions and select the one that best aligns with the organization’s needs and requirements.

- Data Migration:Transfer historical payroll data from legacy systems to the new ERP system accurately and securely.

- User Training:Provide comprehensive training to users on the new ERP payroll system to ensure they are proficient in its use.

- Integration:Integrate the ERP payroll system with other relevant systems, such as HR, timekeeping, and financial management systems, to ensure seamless data flow and automated processes.

- Testing and Deployment:Conduct thorough testing to validate the system’s functionality and performance before deploying it into production.

- Post-Implementation Support:Provide ongoing support to users and assist with any issues or challenges that arise after implementation.

Data Migration, ERP software for payroll

Data migration is a critical step in ERP payroll implementation, as it involves transferring historical payroll data from legacy systems to the new ERP system. Accurate and complete data migration is essential to ensure the integrity and reliability of the new system.

Organizations should carefully plan and execute the data migration process, considering factors such as data mapping, data validation, and data security.

User Training

User training is crucial for successful ERP payroll implementation. Organizations should provide comprehensive training to users on the new system’s functionality, navigation, and reporting capabilities. Well-trained users can maximize the benefits of the ERP payroll system, reduce errors, and ensure efficient payroll processing.

Integration with Other Systems

Integrating the ERP payroll system with other relevant systems, such as HR, timekeeping, and financial management systems, is essential for seamless data flow and automated processes. Integration eliminates manual data entry, reduces errors, and provides a holistic view of employee data across different systems.

Organizations should carefully plan and execute the integration process, considering factors such as data mapping, security, and performance optimization.

Best Practices for ERP Payroll

Optimizing ERP payroll operations is crucial for ensuring efficiency, accuracy, and compliance. By adopting industry best practices, organizations can maximize the benefits of their ERP systems and streamline payroll processes.

Implementing a robust ERP payroll system is the first step towards optimizing payroll operations. The system should be configured to align with the organization’s specific payroll requirements, including pay schedules, tax calculations, and employee benefits.

Centralized Data Management

Centralizing payroll data in the ERP system eliminates the need for multiple spreadsheets and manual data entry, reducing the risk of errors and inconsistencies. A centralized database ensures that all employee payroll information is stored in a single location, accessible to authorized personnel.

Automated Calculations

ERP systems automate complex payroll calculations, such as taxes, deductions, and net pay. This automation eliminates manual calculations and reduces the likelihood of errors. Automated calculations also ensure compliance with tax regulations and labor laws.

Streamlined Approvals

ERP systems provide workflow automation features that streamline payroll approvals. Managers can review and approve payroll transactions electronically, reducing the need for manual signatures and approvals. This automation speeds up the payroll process and ensures timely payment to employees.

Enhanced Security

ERP systems incorporate robust security measures to protect sensitive payroll data. Access to payroll information is restricted to authorized personnel, and audit trails are maintained to track any changes or modifications made to payroll transactions.

Regular System Updates

Regularly updating the ERP system is essential to ensure that the software is up-to-date with the latest tax regulations and labor laws. Updates also address security vulnerabilities and enhance the overall performance of the system.

Employee Self-Service

Providing employees with self-service access to their payroll information empowers them to view pay stubs, update personal information, and make changes to deductions or benefits. This self-service capability reduces the workload for payroll administrators and improves employee satisfaction.

Continuous Improvement

Regularly reviewing and evaluating payroll processes is essential for continuous improvement. By identifying areas for improvement, organizations can refine their ERP payroll operations and further enhance efficiency, accuracy, and compliance.

Emerging Trends in ERP Payroll

ERP payroll software is constantly evolving to meet the changing needs of businesses. Emerging trends include:

- Artificial intelligence (AI) is being used to automate tasks, improve accuracy, and provide insights into payroll data.

- Blockchain is being explored as a way to secure payroll data and provide transparency.

- Cloud computing is making it easier for businesses to access and manage their payroll data.

Artificial Intelligence

AI is being used in ERP payroll software to automate a variety of tasks, such as:

- Data entry

- Payroll calculations

- Tax withholding

- Reporting

AI can also be used to improve the accuracy of payroll data by identifying and correcting errors. Additionally, AI can provide insights into payroll data that can help businesses make better decisions about their payroll processes.

Blockchain

Blockchain is a distributed ledger technology that is being explored as a way to secure payroll data. Blockchain can help to protect payroll data from unauthorized access and tampering. Additionally, blockchain can provide transparency into payroll transactions, making it easier for businesses to track and audit their payroll data.

Cloud Computing

Cloud computing is making it easier for businesses to access and manage their payroll data. Cloud-based ERP payroll software can be accessed from anywhere with an internet connection, making it easy for businesses to manage their payroll from anywhere in the world.

Additionally, cloud-based ERP payroll software is typically more affordable than on-premises software, making it a more cost-effective option for businesses.

Case Studies and Success Stories: ERP Software For Payroll

Organizations that have implemented ERP payroll systems have experienced significant benefits, including improved accuracy, efficiency, and compliance. They have also faced challenges, such as the need for careful planning and implementation, and the potential for disruption during the transition.

Here are some case studies and success stories of organizations that have successfully implemented ERP payroll systems:

Case Study: Company A

- Company A is a large manufacturing company with over 10,000 employees. They implemented an ERP payroll system in 2015, and they have since seen a significant improvement in their payroll accuracy and efficiency.

- Before implementing the ERP system, Company A had a manual payroll process that was error-prone and time-consuming. The ERP system has automated many of the payroll tasks, which has freed up time for payroll staff to focus on other tasks.

- Company A has also seen a reduction in payroll costs since implementing the ERP system. The system has helped to identify and eliminate duplicate payments, and it has also reduced the number of payroll errors.

Case Study: Company B

- Company B is a mid-sized retail company with over 500 employees. They implemented an ERP payroll system in 2016, and they have since seen a significant improvement in their payroll compliance.

- Before implementing the ERP system, Company B had a difficult time keeping up with the ever-changing payroll regulations. The ERP system has helped to automate the payroll compliance process, which has given Company B peace of mind.

- Company B has also seen a reduction in payroll costs since implementing the ERP system. The system has helped to identify and eliminate duplicate payments, and it has also reduced the number of payroll errors.

Vendor Comparison and Market Overview

ERP payroll vendors offer diverse features and pricing models. Comparing their offerings helps organizations select the best fit for their needs.

Market share data provides insights into the industry landscape and vendor prominence.

Vendor Comparison Table

The following table compares key features, pricing, and market share of prominent ERP payroll vendors:

| Vendor | Key Features | Pricing | Market Share |

|---|---|---|---|

| Vendor A | – Comprehensive payroll processing

|

Subscription-based, tiered pricing | 25% |

| Vendor B | – Specialized payroll for complex industries

|

Project-based pricing, customization fees | 18% |

| Vendor C | – User-friendly interface

|

Flat monthly fee, additional charges for add-ons | 15% |

Epilogue

In conclusion, ERP software for payroll has emerged as an indispensable tool for organizations seeking to optimize payroll operations. Its automation capabilities, reporting functionality, and seamless integration with other systems empower businesses to enhance efficiency, accuracy, and compliance.

By embracing the latest trends and best practices, organizations can leverage ERP payroll systems to gain a competitive edge and drive business success.

Essential Questionnaire

What are the key benefits of using ERP software for payroll?

ERP software for payroll offers numerous benefits, including cost savings, improved efficiency, enhanced accuracy, streamlined compliance, and better decision-making.

What are the core payroll functions typically included in ERP systems?

ERP payroll systems typically include core functions such as employee time tracking, payroll calculation, tax withholding, direct deposit, and reporting.

What are the key criteria for evaluating and selecting an ERP payroll system?

When evaluating ERP payroll systems, key criteria include scalability, vendor support, industry-specific requirements, automation capabilities, reporting functionality, and integration options.