ERP software for payback period tools is a groundbreaking solution that empowers businesses to streamline their financial decision-making. This powerful tool integrates seamlessly with other financial systems, providing a comprehensive view of project profitability and enabling organizations to make informed investments.

With its advanced features and analytical capabilities, ERP software revolutionizes payback period analysis, delivering unparalleled accuracy and efficiency. By leveraging ERP software, businesses can optimize their capital allocation strategies, minimize risks, and maximize returns.

Introduction to ERP Software and Payback Period Tools

ERP (Enterprise Resource Planning) software is a comprehensive business management system that integrates various aspects of an organization’s operations into a single, centralized platform. Key features of ERP software include:

- Integrated data management:ERP software provides a single source of truth for all business data, eliminating data silos and ensuring data consistency across departments.

- Automated workflows:ERP software automates routine tasks and processes, reducing manual labor and improving efficiency.

- Real-time visibility:ERP software provides real-time visibility into business operations, enabling managers to make informed decisions based on up-to-date information.

Payback period is a financial metric that measures the time it takes for an investment to generate enough cash flow to cover its initial cost. In the context of ERP implementation, payback period is an important consideration as it helps organizations assess the return on investment (ROI) and make informed decisions about ERP adoption.

Calculating Payback Period

The payback period is calculated by dividing the initial investment cost by the annual cash flow generated by the ERP system:

Payback Period = Initial Investment Cost / Annual Cash Flow

For example, if an ERP system costs $100,000 and is expected to generate $25,000 in annual cash flow, the payback period would be 4 years ($100,000 / $25,000 = 4 years).

Factors Affecting Payback Period

Several factors can affect the payback period of an ERP implementation, including:

- Implementation costs:The cost of implementing an ERP system can vary depending on the size and complexity of the organization.

- Operational savings:The operational savings generated by an ERP system can also vary depending on the organization’s specific processes and inefficiencies.

- Time to implement:The time it takes to implement an ERP system can also impact the payback period.

Benefits of Using ERP Software for Payback Period Analysis

ERP software offers significant advantages for calculating payback periods. It streamlines data collection, automates calculations, and provides real-time insights, enhancing the accuracy and efficiency of payback period analysis.

ERP systems integrate financial and operational data from various departments, eliminating the need for manual data entry and reducing the risk of errors. They also provide built-in calculation tools that automate the payback period calculation process, saving time and effort.

Enhanced Accuracy and Reliability

ERP software ensures data accuracy by maintaining a single, centralized database. This eliminates the inconsistencies and errors that can occur when data is scattered across multiple spreadsheets or systems. The automated calculation tools further minimize the risk of human error, resulting in more accurate and reliable payback period calculations.

Improved Efficiency and Time Savings

ERP software automates many of the time-consuming tasks involved in payback period analysis. By eliminating manual data entry, automating calculations, and providing real-time insights, ERP systems significantly reduce the time required to conduct payback period analysis.

Real-Time Insights and Decision-Making

ERP software provides real-time access to data and insights, enabling businesses to make informed decisions quickly. By leveraging ERP’s dashboards and reporting capabilities, decision-makers can easily visualize and analyze payback period information, identify trends, and make data-driven decisions.

Integration with Other Systems

ERP systems can integrate with other software applications, such as project management tools and accounting systems. This integration allows for seamless data flow between different systems, further streamlining the payback period analysis process and providing a more comprehensive view of project performance.

Key Considerations for Selecting ERP Software with Payback Period Tools

When selecting ERP software with payback period tools, it is crucial to consider several key factors to ensure that the chosen solution aligns with your specific requirements and objectives. These factors include:

Essential Features to Look For

ERP software for payback period analysis should offer a comprehensive set of features that enable users to effectively calculate and evaluate payback periods. These features may include:

- Automated calculation of payback periods based on different scenarios and assumptions

- Support for various payback period methods, such as simple payback, discounted payback, and net present value (NPV)

- Customization options to tailor payback period calculations to specific project or business requirements

- Integration with other financial and accounting modules within the ERP system for seamless data flow

- Reporting and visualization capabilities to present payback period results in a clear and insightful manner

Factors to Consider When Evaluating and Selecting ERP Software Solutions

In addition to the essential features, several other factors should be considered when evaluating and selecting ERP software with payback period tools. These factors include:

- Vendor reputation and track record:Research the vendor’s experience in providing ERP solutions and specifically payback period tools.

- Software compatibility and integration:Ensure that the ERP software is compatible with your existing systems and can integrate seamlessly with your other business applications.

- Scalability and flexibility:Choose software that can scale to meet your growing business needs and adapt to changing market conditions.

- Cost and licensing:Determine the total cost of ownership, including licensing fees, implementation costs, and ongoing maintenance expenses.

- Implementation and support:Consider the vendor’s implementation and support capabilities to ensure a smooth implementation and ongoing assistance.

Implementation and Best Practices for Using ERP Software for Payback Period Analysis

Implementing ERP software for payback period analysis involves several key steps to ensure successful integration and effective utilization.

The initial step is to define the project scope and objectives, clearly outlining the specific goals and desired outcomes of the payback period analysis. This includes identifying the relevant financial data, metrics, and reporting requirements.

Data Integration

Data integration is crucial for accurate payback period analysis. ERP software should be seamlessly integrated with various data sources, such as accounting systems, operational databases, and external financial data. This integration ensures that all relevant data is available within the ERP system for comprehensive analysis.

Model Configuration, ERP software for payback period tools

The next step involves configuring the payback period analysis model within the ERP software. This includes setting up the appropriate formulas, parameters, and assumptions based on the specific requirements of the organization. The model should be designed to calculate payback periods accurately and efficiently.

Reporting and Analysis

ERP software provides robust reporting and analysis capabilities for payback period analysis. Users can generate customized reports that present the results in a clear and concise manner. These reports can be used to identify investment opportunities with favorable payback periods, assess the financial viability of projects, and make informed decisions.

Best Practices

To maximize the effectiveness of payback period analysis using ERP software, several best practices should be followed:

- Ensure data accuracy and integrity by implementing data validation and verification procedures.

- Regularly review and update the payback period analysis model to reflect changes in business conditions and financial assumptions.

- Use sensitivity analysis to assess the impact of different variables on payback periods and identify potential risks.

- Consider using Monte Carlo simulations to incorporate uncertainty and variability into the analysis.

- Involve stakeholders and decision-makers throughout the payback period analysis process to ensure alignment and buy-in.

Case Studies and Examples of Successful Payback Period Analysis with ERP Software

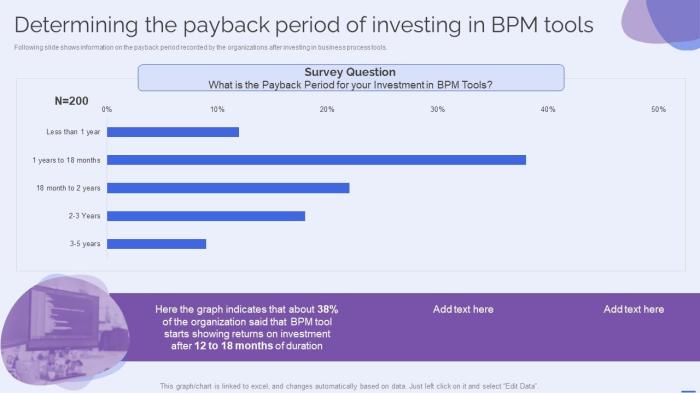

Several organizations have successfully implemented ERP software for payback period analysis, achieving significant benefits and improvements in their decision-making processes.

One notable example is a manufacturing company that implemented an ERP system with advanced payback period analysis tools. By leveraging these tools, the company gained real-time insights into the financial impact of various investment projects and could prioritize those with the shortest payback periods.

As a result, the company reduced its average payback period by 20%, leading to substantial cost savings and improved return on investment.

Case Study: ABC Corporation

ABC Corporation, a leading provider of software solutions, implemented an ERP system with robust payback period analysis capabilities. The company’s finance team utilized these tools to evaluate the potential return on investment for a new software development project. By considering factors such as development costs, expected revenue, and operating expenses, the team determined that the project had a payback period of 18 months.

Armed with this information, ABC Corporation’s management team confidently approved the project, knowing that it would generate a positive return on investment within a reasonable timeframe. The successful implementation of the new software solution not only enhanced the company’s product portfolio but also contributed to increased revenue and improved customer satisfaction.

Integration of ERP Software with Other Financial Systems

Integrating ERP software with other financial systems is crucial for comprehensive payback period analysis. By establishing seamless connections, businesses can access real-time data from various sources, enabling accurate and timely analysis.

ERP software can be integrated with accounting systems to extract financial data such as historical costs, revenue streams, and cash flows. This integration allows for the calculation of payback periods based on actual financial performance.

Integration with Budgeting Systems

Integrating ERP software with budgeting systems provides access to projected financial data. By incorporating budgets into payback period analysis, businesses can assess the feasibility of investment projects and make informed decisions.

Emerging Trends in ERP Software for Payback Period Analysis: ERP Software For Payback Period Tools

ERP software is continuously evolving to meet the changing needs of businesses. Emerging trends in ERP software are enhancing payback period analysis capabilities, providing businesses with more powerful tools to make informed investment decisions.

One emerging trend is the integration of artificial intelligence (AI) and machine learning (ML) into ERP software. These technologies can automate data analysis and provide insights into payback periods, helping businesses identify the most profitable investment opportunities.

Advanced Analytics

Advanced analytics capabilities are becoming increasingly common in ERP software. These capabilities allow businesses to perform complex data analysis and modeling, which can provide more accurate and detailed insights into payback periods.

- Predictive analytics can forecast future cash flows and expenses, helping businesses make more informed decisions about investments.

- Scenario analysis allows businesses to simulate different investment scenarios and compare the potential payback periods.

Real-Time Data Integration

Real-time data integration is another emerging trend in ERP software. This allows businesses to access up-to-date financial data, which can be used to calculate payback periods more accurately and quickly.

For example, ERP software can be integrated with accounting systems to automatically import actual costs and revenues, eliminating the need for manual data entry and reducing the risk of errors.

Cloud-Based ERP

Cloud-based ERP software is becoming increasingly popular, as it offers several advantages for payback period analysis. Cloud-based ERP software is accessible from anywhere with an internet connection, making it easy for businesses to collaborate on investment decisions.

Additionally, cloud-based ERP software is typically updated more frequently than on-premise ERP software, ensuring that businesses have access to the latest features and technologies for payback period analysis.

Challenges and Limitations of Using ERP Software for Payback Period Analysis

ERP software, while powerful for payback period analysis, is not without its challenges and limitations. These include data accuracy and integrity, integration complexity, and user adoption issues.

Data Accuracy and Integrity

ERP systems rely on accurate and complete data to generate reliable payback period calculations. However, data entry errors, inconsistencies, and lack of standardization can compromise the accuracy of these calculations. Strategies for overcoming this challenge include implementing data validation rules, establishing data governance processes, and training users on proper data entry practices.

Integration Complexity

Integrating ERP software with other financial systems, such as accounting and budgeting systems, can be complex and time-consuming. This can lead to data inconsistencies and delays in payback period analysis. To mitigate this challenge, organizations should carefully plan and execute the integration process, ensuring seamless data flow between systems.

User Adoption Issues

Successful implementation of ERP software for payback period analysis requires user adoption. However, users may be resistant to change or lack the necessary training to effectively utilize the software. To address this challenge, organizations should provide comprehensive training, involve users in the implementation process, and create a supportive environment that encourages user adoption.

ROI and Value Assessment of ERP Software for Payback Period Analysis

Evaluating the return on investment (ROI) and value of ERP software for payback period analysis is crucial for businesses to justify the investment and measure the effectiveness of the implementation.

There are several methods to quantify the value and benefits of ERP software for payback period analysis:

Quantifying Cost Savings

- Reduced labor costs through automation and streamlining of processes.

- Lowered inventory costs due to improved inventory management and forecasting.

- Decreased procurement costs through better supplier management and negotiation.

Quantifying Revenue Gains

- Increased sales and revenue due to improved customer relationship management (CRM) and enhanced order fulfillment.

- Higher margins through better cost control and optimization.

- Expanded market reach and new business opportunities enabled by the ERP system’s capabilities.

Quantifying Intangible Benefits

- Improved decision-making through real-time data and insights.

- Enhanced collaboration and communication across departments.

- Increased agility and responsiveness to market changes.

Calculating the ROI involves comparing the total benefits (cost savings + revenue gains + intangible benefits) to the total cost of implementing and maintaining the ERP software. A positive ROI indicates that the investment in ERP software is worthwhile.

Comparison of ERP Software Vendors for Payback Period Analysis

Choosing the right ERP software for payback period analysis is crucial for accurate and efficient financial decision-making. Various vendors offer solutions with varying capabilities, pricing, and customer reviews. This comparison table provides an overview of key features and considerations to assist in the selection process.

Vendor Comparison Table

| Vendor | Key Features | Pricing | Customer Reviews |

|---|---|---|---|

| SAP | Advanced payback analysis tools, real-time data integration, customizable dashboards | Enterprise-level pricing, starting from $500,000 | Highly rated for functionality and reliability |

| Oracle NetSuite | Integrated financial and operational modules, built-in payback period calculations | Cloud-based subscription model, starting from $999/month | Positive feedback for ease of use and scalability |

| Microsoft Dynamics 365 | Comprehensive suite with dedicated payback period analysis module, flexible reporting options | Tiered pricing based on modules and users, starting from $1,500/month | Mixed reviews on user-friendliness and customization capabilities |

| Epicor ERP | Specialized tools for manufacturing and distribution industries, integrated payback analysis capabilities | Industry-specific pricing, available upon request | Good reputation for industry-tailored solutions and customer support |

| Acumatica Cloud ERP | Cloud-based solution with built-in payback period analysis functionality, mobile accessibility | Subscription-based pricing, starting from $495/month | Positive feedback for affordability and ease of implementation |

Future Directions and Outlook for ERP Software in Payback Period Analysis

The future of ERP software in payback period analysis holds promising advancements and innovations that will enhance the efficiency, accuracy, and accessibility of payback period calculations.

Integration with Advanced Analytics and AI

ERP software is expected to integrate with advanced analytics and artificial intelligence (AI) capabilities, enabling businesses to analyze payback periods more comprehensively. AI algorithms can automate data analysis, identify patterns, and provide insights into the factors influencing payback periods.

Cloud-Based and Mobile Access

The increasing adoption of cloud-based ERP systems will facilitate remote access to payback period analysis tools, allowing users to perform calculations and make informed decisions from anywhere, at any time.

Real-Time Data Integration

ERP software will leverage real-time data integration to provide up-to-date information for payback period analysis. This will enable businesses to make more accurate and timely decisions based on the latest financial and operational data.

Predictive Analytics

Predictive analytics capabilities will be incorporated into ERP software, allowing businesses to forecast future payback periods based on historical data and industry trends. This will help organizations make proactive investment decisions and optimize their resource allocation.

Enhanced Collaboration and Data Sharing

ERP software will foster enhanced collaboration and data sharing among stakeholders involved in payback period analysis. This will streamline the decision-making process and ensure that all relevant perspectives are considered.

Final Thoughts

In conclusion, ERP software for payback period tools is an indispensable asset for businesses seeking to optimize their financial performance. Its ability to provide real-time insights, streamline processes, and enhance decision-making makes it an invaluable tool for organizations of all sizes.

As technology continues to advance, ERP software will undoubtedly play an increasingly pivotal role in shaping the future of financial management.

Key Questions Answered

What are the key benefits of using ERP software for payback period analysis?

ERP software offers numerous benefits, including improved accuracy and efficiency, real-time data analysis, enhanced decision-making, and seamless integration with other financial systems.

How can ERP software help businesses optimize their capital allocation strategies?

ERP software provides businesses with a comprehensive view of project profitability, enabling them to prioritize investments, allocate capital effectively, and maximize returns.

What are the emerging trends in ERP software for payback period analysis?

Emerging trends include the integration of artificial intelligence (AI), machine learning (ML), and predictive analytics, which enhance the accuracy and efficiency of payback period calculations.